10 Points to Consider when Selling Your Business

Selling your business is one of the most important financial transactions. It is important to approach it armed with as much information as possible.

10 Steps to Managing Inheritance and New Wealth

Coming into money brings opportunities and challenges, and in many cases, mixed emotions. Recipients of new wealth have many financial issues to consider.

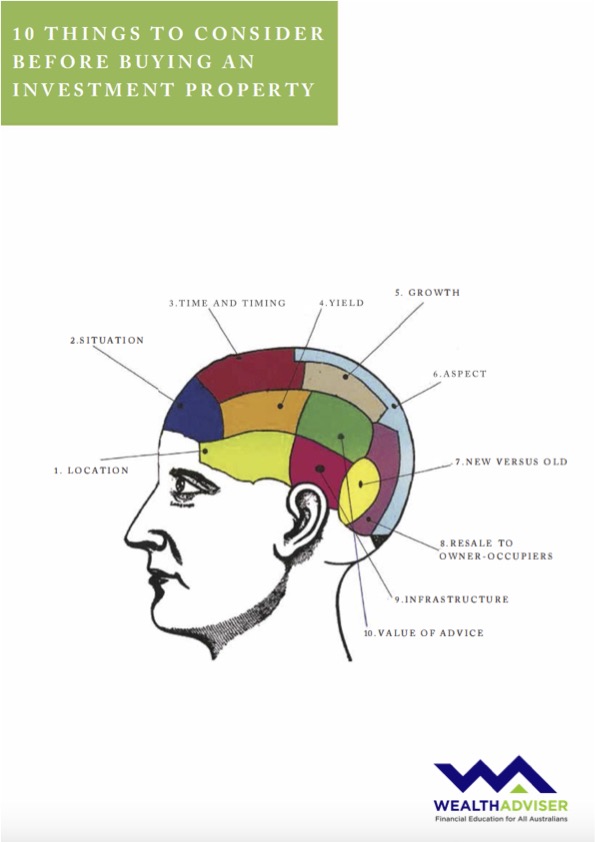

10 Things to Consider Before Buying an Investment Property

Find out what makes or breaks a potential investment property. Buying property can be exciting and nerve racking at the same time. It can be emotional and logical. This eBook covers those items you should consider before buying a rental property.

13 decision-making mistakes that investors make… and how to avoid them

It’s important to understand common investment decision-making mistakes and how you can avoid them. At the end of the day, good investment decision-making lowers your risk and improves your returns.

13 Strategy Insights into Positive Cash Flow Property

Finding properties that pay for themselves is hard but not impossible. Learn the signs of a cashflow positive property.

14 Best Sydney Suburbs

Sort out the best from the rest with our guide to Sydney’s best suburbs for property investment. We hope that this guide will help you with your search.

15 Tax and Investment Mistakes to Avoid for SMSF Direct Share Investors

Direct share ownership is a very popular mode of investing for SMSF trustees. That being said, there are investment and tax mistakes that are best avoided.

17 Government benefits all retirees should know about

There are specific ages when you become eligible to access a range of government financial benefits in retirement. In this eBook, we look at each of these government financial benefits, their specific eligibility requirements, and how you can claim them.

19 Facts & Insights for Dealing with Redundancy

Leaving or losing your job is surely one of the most stressful events we could experience. This eBook is designed to give you some guidance to help you through this tough time.

23 Transition to Retirement Strategy Insights

If you reached your preservation age but are still working you may want to consider a Transition to Retirement Pension as part of your retirement planning strategy. Combined with salary sacrifice contributions, a TTR pension can be an effective retirement planning tool available.

35 End of Financial Year Tax & Superannuation Tips & Strategies – FY2021 Edition

Discover strategies to legally minimise your tax obligations as an individual or a business as well as strategies to grow your superannuation. We also cover some tax traps and how to avoid them!

38 Tips & Insights for First Home Buyers

Buying a home is a major investment but can return significant financial gains to kick-start your wealth-building program.

6 Things to Understand About the Canberra Property Market Plus top 5 Suburbs

Considering purchasing a property in the nation’s capital? Discover the top 5 Canberra suburbs to watch.

7 Insights to Avoid a Ruined Retirement

If you are retired or planning your retirement you need to first understand the challenges that lie ahead of you and then develop a plan to navigate and avoid them.

7 Insurance Strategies to Manage Risk

What are the best insurance strategies at the moment both personal and business. Insurance, superannuation and tax planning are now more integrated than ever.

This eBook has been written to give you an up to date perspective on the subject.

7 Steps to Financial Freedom

There are certain steps and habits, that if acted on and followed lead to very positive financial outcomes. We have written this eBook to highlight some of the more important ones.

7 Things to know about SMSF Loans (plus Do’s and Don’ts)

Prior to 2007 SMSFs were not allowed to borrow for investment purposes, which meant that property investment wasn’t an option for most fund members. It is now possible for SMSFs to borrow funds under some clearly defined conditions.

8 Most Important Things to Know About My QSuper

Many of our Queensland clients have a QSuper account, we have noticed over the years a range of questions and uncertainties regarding how QSuper works.

Buying Property with Super – The Pros & Cons

Did you know you may be able to use your super to buy an investment property? Would you like to find out how? This eBook has been written to help you navigate this opportunity and understand the risks and mistakes to avoid.

Consolidating Your Super – The Ultimate Guide (and mistakes to avoid)

The purpose of this eBook is to provide information on consolidating super. If you’ve changed jobs over the years, it’s likely that you’ll have more than one superannuation account.

Contributing to Superannuation

Contributing to super will grow your nest egg to fund your retirement. Learn about the different types of contributions and taxation of each. Contributions to super include employer contributions, after tax contributions, salary sacrifice and deductible self-employed contributions.

Divorce & Separation: A Financial Guide

Relationship breakdown and divorce affects every aspect of your life, and the financial side is no exception.

Doctors Guide to Financial Advice

Find out the challenges faced by doctors in managing their money and making their wealth creation aspirations come true.

Downsizing – 13 Insights to improve your thinking on the subject

Downsizing is one of the biggest and hardest decisions you may ever make. More and more Australians will grapple with this challenge in years to come.

Establishing and Operating a Self Managed Super Fund

Are you considering establishing your own Self Managed Super Fund? This unique eBook has been written specifically for you.

ETFs – Understanding how Exchange Traded Funds work

Exchange traded funds (ETFs) are a managed investment vehicle that you can use to access a wide variety of investment markets.

ETFs, LICs and Unlisted Managed Funds – What’s the difference?

In this e-book, we explain the key differences between ETFs, LICs and unlisted funds. We also provide answers to FAQs and outline the pros and cons of each investment option.

Financial Health Check – 14 Questions You Should Ask Yourself

Would you like a Quick Financial Health Check? Download this easy to use tool that helps you evaluate the current health of your finances.

Financial planning & superannuation for same-sex couples

This eBook provides an overview of the financial planning and superannuation relates issues uniquely faced by same-sex couples in Australia.

Financial Planning & Superannuation for Women

Women have some specific financial issues and concerns that they are faced with. This eBook has been written to help you understand those issues and navigate them.

Financial Planning for Australian Pilots

Are you a Professional Pilot? This unique eBook has been written specifically for you.

Financial Planning for Professional Athletes

Professional athletes, no matter what stage of your career; often have unique financial needs & circumstances. This eBook has been written to help you navigate your unique concerns and issues.

Financial Planning for Surgeons

As a surgeon you would be faced with some unique financial challenges and considerations. This unique eBook has been written specifically for you.

Guide to Buying an Apartment

More and more Australians are opting for an apartment rather than a detached house. Find out what you need to know in your search for the perfect apartment.

Guide to Refinancing

This eBook provides a deeper insight into the pros and cons of refinancing and should you want to do it, how best to go about it.

How many properties do I need to retire?

Building a portfolio of investment properties is a legitimate retirement strategy used by many Australian investors. It requires specific knowledge, patience and discipline.

How much money do I need to retire?

Everyone wants to have some idea if they are on track for a comfortable retirement or if they are not, how far off are they?

How to buy commercial property in an SMSF

We have produced this eBook so clients have a foundation level understanding on how to invest in Commercial Property within an SMSF.

How To Find A Good (And Right) Financial Planner For You

Not all Financial Planners are the same. Being able to distinguish between all the different types of planners is not easy. So how do you find the best advisor for you?

How To Get The Best Price For Your Home

Selling your home for any price is easy, but getting the best price is not. If you are selling in the near future then this unique eBook has been written specifically for you.

How to Survive the Financial Crisis

Are you one of the many people worried about the future? Read our guide on dealing with uncertain times and find out what you can do to protect yourself now.

How to Use NRAS to Create Positive Cashflow Investment Property Wealth

The idea of a 90% financed or even 100% financed investment property being cashflow positive from day one sounds attractive to anyone right?

How to use your SMSF to buy NRAS property

The combination of NRAS and an SMSF can be a very powerful strategy for the right people. This is a unique eBook that goes into the details of NRAS & SMSF.

Introduction to SMSFs

There are almost 600,000 self-managed super funds (SMSFs) in operation in Australia. SMSFs are not suitable for everyone. Learn about what an SMSF is, how they are regulated and becoming a trustee of your own super fund.

Is Your Nest Egg Safe?

Planning for retirement has never been harder as we now live in a world where markets are more volatile than at any other time in history.

Money & Marriage: A Guide to Domestic Financial Bliss

Find out how you and your partner can work together as a team to create a more prosperous future together.

Moving Across the Ditch – New Zealand

We have written this eBook for the ever increasing number of New Zealander’s migrating to Australia.

Moving to The Land Down Under – British Immigrants

Immigration is an amazing time in one’s life. This eBook has been written for those immigrating to Australia from Britain.

Moving to The Land Down Under – South Africa

Immigration is an amazing time in one’s life. This eBook has been written for those immigrating to Australia from South Africa.

Planning a Career Change

With the help of author Alison Nancye we have produced an eBook focused on helping you manage your change of career.

Property Research Secrets

Property experts go through a particular thought process to find and identify value in real estate transactions. This eBook is an insight into that thought process.

Property vs Shares: A new guide to an old question

This is a question on most investors’ minds. We have produced this eBook to help you think about and answer the question in a rounded and holistic manner.

Renting Out Your Family Home: Implications for When You Move into Aged Care

In this eBook, we will look at the pros and cons of keeping your home and renting it out versus selling it. We will also look at a number of case studies.

Renting vs Buying – Which is better in the long run?

Should I buy an investment property or a home? This question is being asked by more and more Australians in the last 5-10 years as getting into the property market gets harder.

Rentvesting: Your guide to why, when, where and how

A classic question in the property market has always been – buy or rent? Rentvesting allows you to do both. This eBook will help you understand the Rentvesting strategy.

Returning to Australia: an Expats Guide

If you are an Australian expat returning (or thinking of returning) to Australia, then this eBook is for you.

SDA Investment Insights – Specialist Disability Accommodation explained

Is Specialist Disability Accommodation really all that it seems? This eBook provides an overview of the scheme and explores not just the investment opportunity but what the potential pitfalls are.

SMSF Investment Rules

There are specific investment rules that must be followed to ensure an SMSF remains eligible for tax concessions. Learn about the types of investments your SMSF can and can’t invest in and lending and borrowing restrictions.

SMSF Trustee Responsibilities

Setting up your own SMSF requires you to become a trustee of the fund. This is an important decision that carries certain duties and responsibilities.

Tax Deductions for Property Investors

Are you paying more tax than you have to? This easy-to-understand guide outlines which costs of your investment property are deductible and which are not.

Taxation of Employee Share Schemes

If you have shares in an employer/employee share scheme, this eBook has been written to help you navigate some of the questions and issues you may have.

Taxation of SMSFs

An SMSF is subject to specific concessional taxation rules, so long as the fund complies with the government’s super rules.

Teacher’s Guide to Financial Planning

Teachers have their own unique set of financial considerations and concern. We have written this eBook for you hoping that you extract some value and insight from it.

Ten trends that will affect retirement in Australia

It seems change is the only constant in these turbulent times. Here are ten trends that will have an impact on the retirement of Australians.

The 11 Greatest NRAS Mistakes – Not to Make!

Increasingly, property investors are looking to the National Rental Affordability Scheme as a means of creating cashflow positive investment property wealth.

The Benefits of Investing in Australian Residential Property

Australian residential property has performed admirably over the last 40-50 years and created substantial wealth for a large portion of the Australian population.

The Top 15 Pros & Cons of Defence Housing (DHA)

Defence Housing is a popular investment strategy for many Australians. We have written this eBook to help clients improve their thinking on this strategy.

The Ultimate Guide to Budgeting

Planning for the future starts with a budget and we have written this eBook to help you start the process of getting your budgeting and planning in order.

The Ultimate Guide to Company Compliance

Company compliance is a maze. We have produced this eBook to help our clients that have either corporate trustees or an operating company.

The Ultimate Guide to LRBAs

We have produced this eBook to help shed light on a wide range of both simple and complex issues relating to LRBAs (Limited Recourse Borrowing Arrangements).

The Ultimate Guide to Mortgage Reduction

We have produced this eBook to bring together a collection of ideas and strategies that can help you to pay off your mortgage and sooner.

Thriving Through the Immigration Experience

This eBook has been written for those immigrating to Australia from anywhere in the world with the objective of making the transition easier and smoother.

Top 10 Best Brisbane Suburbs

Not all suburbs are equal. We have produced this eBook for those looking to invest in Brisbane real estate for the long term, rather than shorter term speculation.

Top 10 Best Melbourne Suburbs

Not all suburbs are equal. We have produced this eBook for those looking to invest in Melbourne real estate for the long term, rather than shorter term speculation.

Top 10 Estate Planning Mistakes to Avoid

Personal estate planning is often overlooked and even when we do get around to it there is a long list of mistakes that should be avoided.

Top 10 Mistakes to Avoid With Negative Gearing

This eBook has been written for our existing and prospective clients to outline many of the costly mistakes that should be avoided with negative gearing.

Top 10 Strategies to pay for Private School Fees

Sending your children to a private school is one of the most expensive things you will ever do. Learn the strategies to help fund private school fees.

Top 10 Things To Know About VicSuper

VicSuper is one of the largest public sector super funds in Australia. Many of our prospective and existing clients have VicSuper accounts. We have written this eBook for them.

Top 11 Family Trust Mistakes Not To Make

Do you have a Family Trust or are you considering one? Read this eBook to avoid many of the mistakes people make.

Top 12 Mistakes to Avoid When Setting Up an SMSF

An SMSF is a very important decision. The fewer mistakes you make the better. This eBook is written for anyone considering an SMSF and is not sure of what to expect.

Top 13 Insights for High-Income Earners ($5m+)

High income and high net worth clients have unique issues that they need to consider in their planning. Finding advice that caters for those issues can be harder than you think.

Top 13 Mistakes to Avoid with Granny Flats

Granny flat construction is on the upward trend in Australia. Be aware of the potential pitfalls before embarking on development of a granny flat.

Top 13 SMSF Property Mistakes

This eBook has been written to give some insight into the issues that need to be considered and to help you avoid many costly mistakes when buying property in super.

Top 13 Strategies to Reduce Your Capital Gains Tax

Capital Gains Tax can be a large and unexpected expense. This eBook has been written to examine the strategies available to legally manage your tax liability.

Top 15 Super and Tax Strategies

Superannuation and taxation can’t be avoided in Australia. Learn strategies on how you can use these financial vices to enhance your situation.

Top 16 Ideas & Insights into Annuities

Many investors feel that they don’t understand annuities and find them confusing, but they can be a powerful part of a diversified portfolio.

Top 16 Strategies and Insights to Help Your Adult Children into the Property Market

Getting into the property market is the hardest it has ever been. In this eBook you will learn the strategies to help your adult children break into the market.

Top 18 Pros and Cons of Testamentary Trusts

A testamentary trust is one of the most effective and powerful estate planning tools available. A testamentary trust can have a wide reaching and multi-generational impact on family wealth.

Top 21 Insights Into Negative Gearing Plus Mistakes To Avoid

Negative gearing is a strategy used by many successful investors. In this free eBook you will find out the essentials in assessing this tool as part of a wealth creation strategy.

Top 26 End-of-Year Financial Year Tax & Superannuation Strategies

The purpose of this eBook is to provide information about end of year tax and superannuation planning. This includes strategies to legally minimise your tax obligation as an individual or a business and as well as strategies to grow your superannuation. We will also provide advice on potential tax traps and how you can avoid them.

Top 6 Things You Should Know About the Div 293 Tax

If you earn over $300,000 then you owe extra tax on your super contributions. It’s called Division 293 Tax. Learn more about this tax.

Top 7 Mistakes when choosing a Financial Planner

It can be challenging finding the right planner for you. The purpose of this eBook is to help you avoid some of the mistakes people make when choosing a financial planner.

Top 9 Things to know about Salary Packaging and Mistakes to Avoid

Salary packaging can possibly allow you to pay for expenses from pre-tax salary and increase your net cash flow.

Understanding Aged Care In Australia

If you’re considering Aged Care for yourself or one of your loved ones, it’s important to understand the basics of how Aged Care works in Australia before you make any decisions.

Understanding Group vs Retail Life Insurance

If you need to take out life insurance to protect yourself and your loved ones financially, you have three broad options – group life insurance, retail life insurance, or arranging life insurance yourself directly through an insurer.

Understanding Insurance Jargon Plus 5 Things To Consider

The purpose of this guide is to take some of the mystery and confusion out of insurance by providing you with an overview of the different types of insurances available.

Understanding The Living Away From Home Allowance

Living and working away from home is a reality for many Australians. You may work for an employer that offers a LAFHA.

Understanding The Pension Loans Scheme

The Pension Loans Scheme is a federal government initiative to help Australian retirees to supplement their income. Many Australian retirees have the bulk of their assets tied up in residential property. They are often said to be “asset rich but cash poor”.

What expert investors know about property auctions

Going to an auction unarmed with knowledge is a dangerous thing to do. This eBook will give you an insight into how to best survive in an auction environment.

Winding up an SMSF

Winding up or closing an SMSF may occur for a number of reasons such as relationship breakdown or bankruptcy. Learn about trustees’ obligations to members and regulators. Or Learn about the steps in closing an SMSF.

Withdrawing money from superannuation

In most cases your super cannot be withdrawn until you reach a certain age or retire. Learn about withdrawing your super as a lump sum or in the form of an income stream.

Your Guide to Buying Off The Plan

Buying off the plan has its advantages and pitfalls. This is a unique eBook written for those interested in embarking on such a strategy.

Your Guide To SAFs

The purpose of this eBook is to provide an overview of SAFs to enable you to come to an informed decision on whether it could be an answer to your investment needs.

Your guide to SMSF Property Loans

With the popularity of SMSFs on the rise, more and more Australians are looking at borrowing to invest and buy property with their superannuation.